Well-targeted financial incentives such as lower local government taxes would encourage green building adoption in the marketplace. The revised Haryana building bye-laws 2016 recognise green building measures by project and awards benefits of additional FAR up to 25 per cent by getting the buildingsiteproject certified from GRIHA Council and achieve GRIHA rating as per sub 4 or adopting green norms.

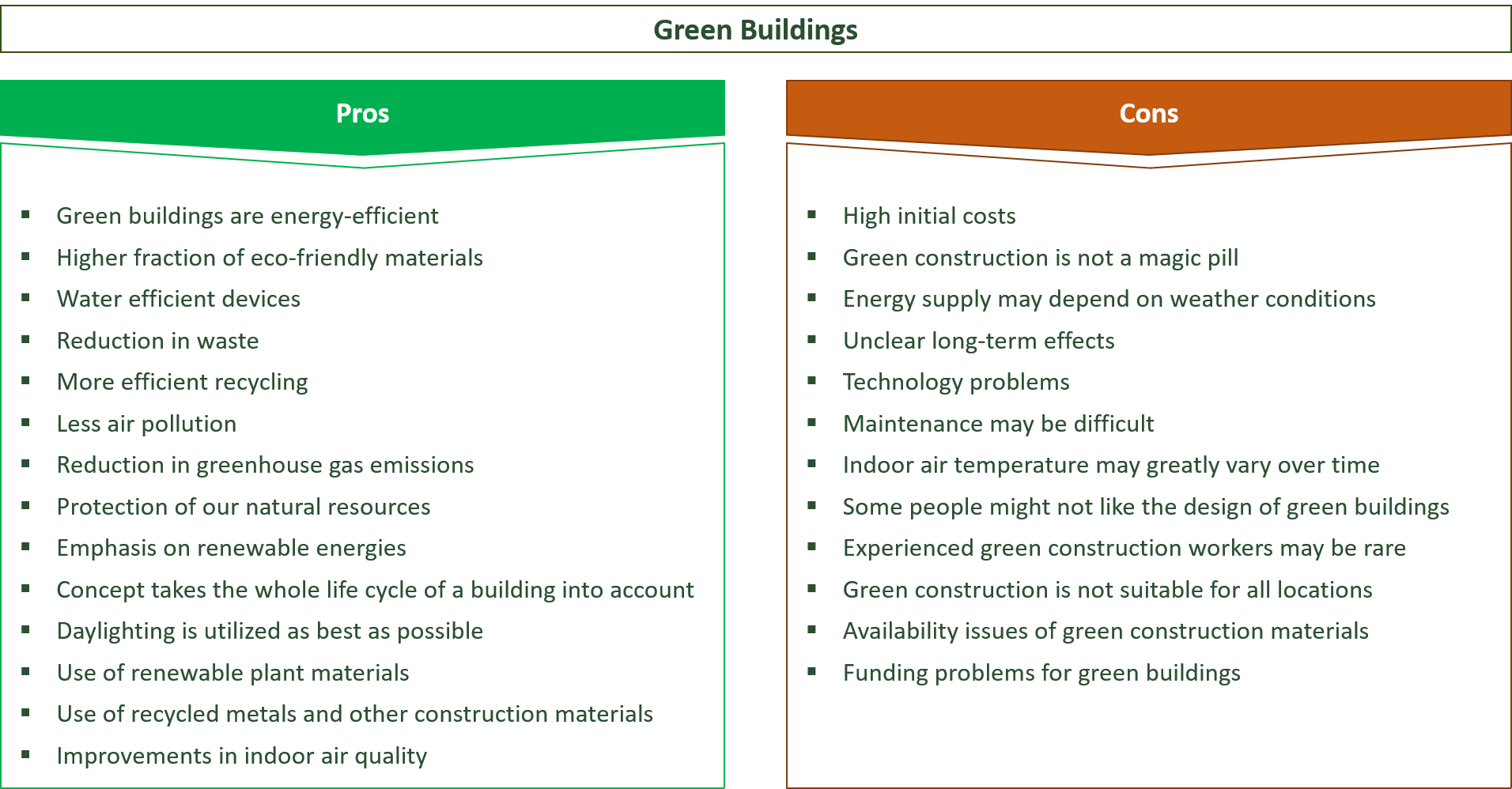

Pros And Cons Of Green Buildings Do The Advantages Outweigh The Disadvantages Sf Magazine

If you want to revive your business building and turn it into a green building you can get a tax deduction for this purpose.

Tax benefits for green building in india. Green Tax on Vehicles. The green buildings in the state are proposed to be incentivised on the basis of the benchmarks prescribed by green building certification systems including Leadership in Energy and Environmental Design LEED Indian Green Building Council IGBC Green Rating for Integrated Habitat Assessment GRIHA and Excellence in Design for Greater Efficiencies EDGE. The Maharashtra government is planning to give tax sops to developers to incentivize construction of green buildings in both residential and commercial spaces.

Green buildings can reduce the footprint of greenhouse gas emissions by 20 said Valsa Nair-Singh secretary environment department adding that the government plans to take up promotion of green buildings as a mission. The terms green building homes and green homes are used interchangeably in this article. The removal of fossil fuel subsidies would also be able to strengthen economic incentives for green building practices.

The tap water approach to designing green buildings. For the home owner the payback period during which the capital cost is recovered is an essential value that is delivered through. Tax credit bonds have been a huge part of the development of bond markets in the United States.

In Maharashtra the Pimpri-Chinchwad Municipal Corporation offers up to 15 rebate on property tax for green buildings and up to 50 on premium for. Green buildings movement should become peoples movement says Vice President Naidu. Additional FAR for all building users except plotted residential.

Chief minister Prithviraj Chavan has been pushing the administration to evolve a uniform code for green buildings. Notably they have driven capital into oil and gas industries for 100 years and helped underwrite their expansion. Green tax on vehicles in India is a relatively new trend but RFID tags are being given and CCTV cameras have been deployed at border entry points in Delhi to ensure that commercial vehicles that enter the city will be monitored for emissions.

Tax incentives are attractive from a cost-efficiency perspective as it can provide a big boost to investment with a relatively low impact on public finances. The plan is to give 3-7 rebate on property tax for such buildings across municipal corporations and councils though the government is yet to define what exactly would make for a green or eco-friendly building. Green buildings to get 50 rebate in property tax at Dharamshala.

The buyers of property in green building will be entitled to a property tax rebate for a period of five years from securing the Occupancy Certificate OC based on the green building rating of the property secured from the empowered agencies. Rajkot first to get Green Building Certificate for PMAY scheme. Savings by building green.

Green buildings certified by the Indian Green Building Council IGBC results in energy savings of 40 - 50 and water savings of 20 - 30 compared to conventional buildings in India. Investing in energy efficiency across Indias urban areas is key considering that cities contribute about 62 percent of Gdp in India which is likely to increase to 75. The Greater Hyderabad Municipal Corporation GHMC is planning to reduce city level impact fee to eco-friendly buildings based on the green rating Commissioner MT.

Green buildings growing at 15 per year in Indore. This Section 179D deduction is for incorporating high energy systems into your building such as high-efficiency interior lighting HVAC or. Claim a tax deduction of 50 per cent of the cost of the eligible assets or capital works for upgrading buildings Tax Breaks for Green Buildings - Bulletpoint - GovtGrant Consultant From 1 July 2011 businesses that invest in eligible assets or capital works to improve the energy efficiency of their existing buildings.

The energy efficiency of green homes is a key benefit that subsequently lowers operating costs. Simple frugal and sufficient.

124 Questions With Answers In Green Building Science Topic

Review Of Barriers To Green Building Adoption Darko 2017 Sustainable Development Wiley Online Library

Towards The Next Generation Of Green Building For Urban Heat Island Mitigation Zero Uhi Impact Building Sciencedirect

34 Main Pros Cons Of Green Building E C

Tax Benefits Home Loans Loan Benefit

Net Zero Energy Diagram Grass Building Maryland Mechanical Room Zero Energy Building Building

Modern Green Building Fire Protection Fire Protection Green Building Fire Suppression

Towards The Next Generation Of Green Building For Urban Heat Island Mitigation Zero Uhi Impact Building Sciencedirect

124 Questions With Answers In Green Building Science Topic

Property Tax Assessment Incentives For Green Building A Review Sciencedirect

Will Green Building Development Take Off An Exploratory Study Of Barriers To Green Building In Vietnam Sciencedirect

Property Tax Assessment Incentives For Green Building A Review Sciencedirect

Towards The Next Generation Of Green Building For Urban Heat Island Mitigation Zero Uhi Impact Building Sciencedirect

Green Building Incentives A Review Sciencedirect

124 Questions With Answers In Green Building Science Topic

Need For Developing Green Building Concept In The Country

Greening By Liufuyu The Greening Of The Office Building Liufuyu Greening Building Office Office Building Residential Building Design Building

Komentar

Posting Komentar