Not only are corporations eligible for California energy credits but federal as well. Projects which qualify for tax-exempt status or utilize tax credits and deductions including New Market Tax Credits NMTC Brownfields and Federal Historic Rehabilitation may also take advantage of green building incentives.

Green Energy Tax Credits For Home Improvement Energy Efficiency In 2020 Diy Home Security Energy Efficiency Eco Friendly House

Again the credit is worth 30 of the cost of the purchase and installation.

California green building tax credits. Net Zero Energy homes cost less to own. Residential renewable green tax incentives allow you to reduce California taxes by up to 40 of the cost of any applicable systems you install in your business up to a total cost of 10000 up to 4000 of tax credit. Welcome to Green California.

Federal state and local governments have created and extended over 2000 financial incentive programs to reward energy efficiency and the use of alternative energy in the design construction and improvement of buildings and homes. You can sell your excess solar power production to investor-owned utilities at near-retail prices thanks to California net metering rules. Rebates and tax credits CDTFA is Going Green In an effort to be green and reduce paper the CDTFA is moving to the electronic filing of returns electronically providing information such as tax rate changes newsletters tax and fee updates public meeting agendas and announcements.

State Green Tax Credits. From rebates for solar panels to fee waivers for projects exceeding existing energy efficiency standards there are numerous incentive programs to be considered when deciding if. Dont get too bent out of shape if the tax credit disappears as a good agent should be able to negotiate more than a 10K credit and maybe more sustainable offerings if you play your cards right.

An income tax credit provided to owners or tenants of green buildings and green building components. Under current law the green building tax credit is tied to the LEED or its equivalent. The County caps the overall tax expenditure for this credit at 5 million annually.

Green Investment Tax Credits Form 3468 is a general investment tax credit that includes several different credits. Solar illumination and solar energy property. Some of these tax credits are being reduced to 22 for property construction beginning in 2021.

Geothermal heat pumps qualify for a tax credit equal to 23 of equipment and installation costs with no upper limit through 2022 and a 22 tax credit in 2023. The credit expires at the end of 2023 unless Congress chooses to extend it. The State of California its subdivisions and its utilities have a host of incentive programs designed to encourage the implementation of green building practices.

The California solar tax credit is actually the federal Investment Tax Credit ITC and its worth 26 of your total solar panel costs. California is reducing its environmental footprint through sustainable state government operations and practice including energy efficient state building design and construction renewable energy generation at state facilities environmentally preferable state purchasing and sustainable state-owned vehicles. Taxpayer or builder is eligible for a 22.

The credit is 2000 for a dwelling unit that is certified to have an annual level of heating and cooling energy consumption at least 50 below the annual level of heating and cooling energy consumption of a comparable dwelling unit and has building envelope component improvements that account for at least 15 of the 50 reduction in energy consumption. The long-term financial benefits of energy efficient homes are well established. The limit is 500 per half-kilowatt of capacity.

According to data from Incentify Northrop Grumman Corp. Buildings such as San Franciscos Arterra which is on target to receive a LEED Silver up from LEED-NC which we previously had been informed does offer some unique Green attributes. The biggest financial challenge is the up-front investment for the materials and labor.

New and existing buildings meeting higher levels of LEED certification receive increasingly higher levels of the property tax credit for five and three years respectively. Green Building Tax Incentives. LAs biggest green tax credits and incentives recipients however are not renewable energy companies.

The credit equals eight percent of the allowable costs 120 per square foot of the base building60 per square foot of the tenant space for green buildings. Fortunately many utilities and agencies as well as the federal government offer financial incentives. There are also tax credits available for both microturbine and fuel cell systems.

Property Tax Assessment Incentives For Green Building A Review Sciencedirect

Green Building Incentives A Review Sciencedirect

Https Www Jstor Org Stable 24787308

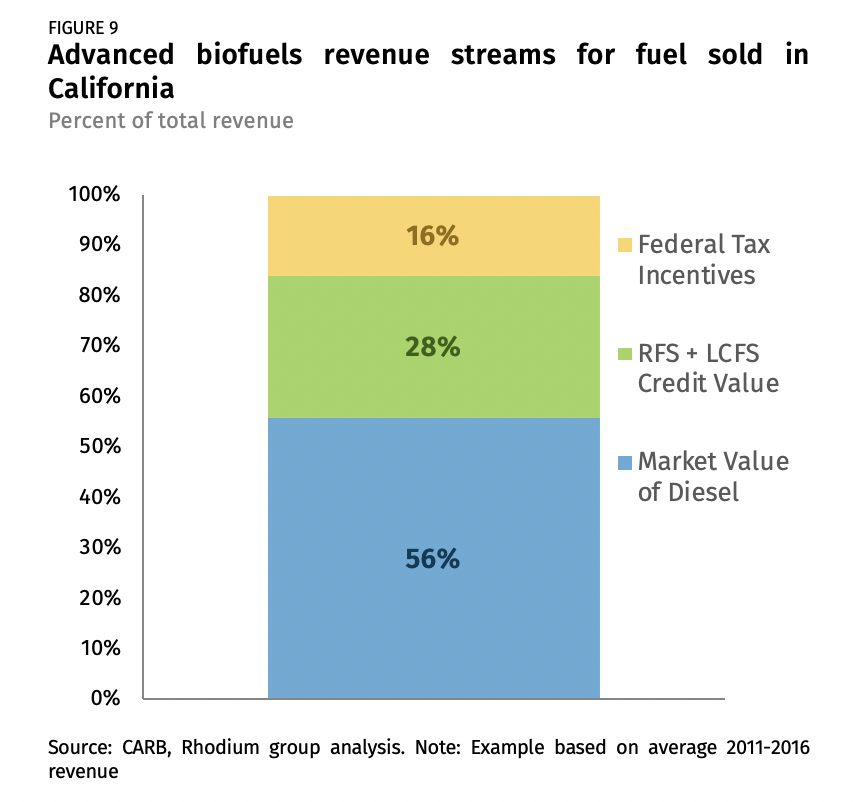

Can Tax Credits Tackle Climate Rhodium Group

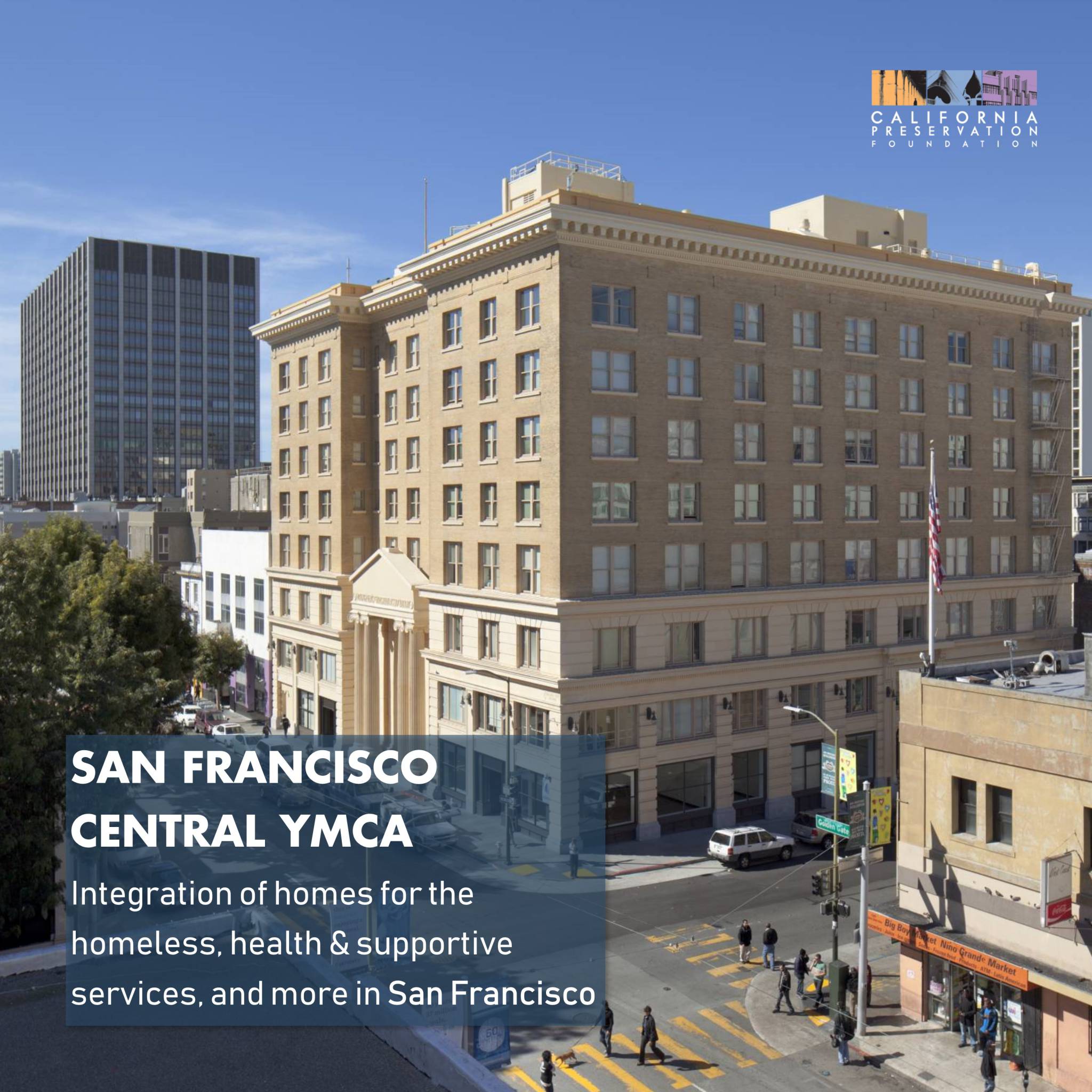

Federal Historic Preservation Tax Incentives Program

Builders And Developers Can Collect 2 000 Of Tax Credit For Each New Dwelling Unit Single Family Or Multi Family Residenc Tax Credits The Unit Energy Audit

Property Tax Assessment Incentives For Green Building A Review Sciencedirect

Dig It Way To Go California Energy Efficient Buildings Energy Saving Technology Save Energy

These Green Tax Credits Are Set To Expire Unless Congress Renews Them

Accounting Rules For Energy Tax Credits Divide Utilities Solar Producers Wsj

Green Energy Tax Credits For Home Improvement Energy Efficiency

Sb 451 Ca Historic Rehabilitation Tax Credit Los Angeles Conservancy

New Law California Offers Tax Credit To Undocumented Workers Calmatters

Sb 451 Ca Historic Rehabilitation Tax Credit Los Angeles Conservancy

2019 Tax Credits Bill California Preservation Foundation

Why The Solar Tax Credit Extension Is A Big Deal In 2020 Energysage

Financial Support Available For California Jurisdictions And Businesses

Komentar

Posting Komentar